SK Hynix to Build a New NAND Fab, Upgrade Existing DRAM Fab

by Anton Shilov on December 23, 2016 11:59 AM EST

SK Hynix on Thursday announced plans to build a new manufacturing facility to produce NAND flash memory in South Korea, and also upgrade its DRAM production plant in China in a bid to sustain its production capacities. Both projects will initially cost SK Hynix about $2.6 billion (₩3.15 trillion) and are expected to be completed in 2019-2020. Over that time, the company will also invest additional money in the expansion of DRAM and NAND production in South Korea.

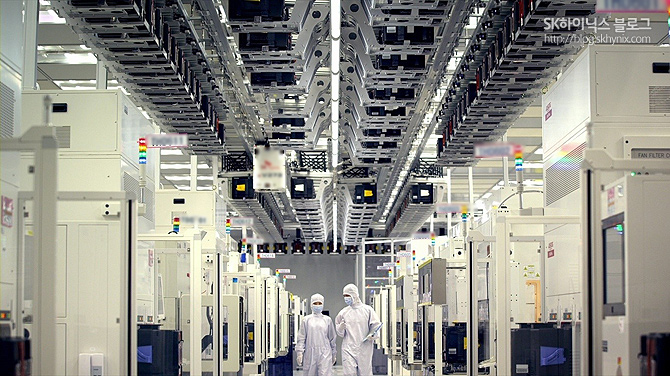

The new fab will be located in Cheongju, South Korea, not far from the company’s existing M8, M11 and M12 manufacturing facilities. SK Hynix intends to start the design of the new fab in January and begin construction of the shell and the cleanroom space in August. The company hopes to complete the building in June 2019, and by then finalize decisions regarding equipment installation based on market conditions. If everything proceeds as planned, the new fab will process the first wafers already in late 2019 and will make a sizeable contribution to SK Hynix's revenue by late 2020. SK Hynix intends to spend $2.08 billion (₩2.2 trillion) on construction alone (a little lower than the manufacturer spent on the building for its massive flagship M14 plant) and then will have to invest in production tools.

SK Hynix does not reveal details about production capacity of the upcoming fab and does not share the area of its cleanroom space. However, judging by the investment in the building itself, the memory producer is set to build another giant manufacturing facility. Today, SK Hynix processes around 300 thousand DRAM wafers (300mm) and 230 thousand NAND flash wafers (also 300mm) at its different fabs every month. A significant portion of SK Hynix's memory is made at its M14 fab, which monthly output (used to make both DRAM and NAND) is getting closer to a target of 200 thousand wafer starts per month, but is not there yet. The new fab will further increase 300-mm production capacities owned by SK Hynix.

| Overview of SK Hynix Manufacturing Capacities | ||||||||||

| Icheon, South Korea | Cheongju, South Korea | Wuxi, China | ||||||||

| M14 | M10 | M8 | M11 | M12 | Future | C2 | ||||

| Maximum Production Capacity (300-mm wafer starts per month) |

<200K now 300K after upgrades |

130K | - | 50K | 40K | TBD | 130K | |||

| Application | DRAM | Yes | Yes | - | Yes | Yes | Yes | Yes | ||

| NAND | 2D + 3D | 2D + 3D | - | 2D | 2D | 3D | 2D | |||

| DDIC | - | - | Yes | - | - | - | - | |||

| PMIC | - | - | Yes | - | - | - | - | |||

| CIS | - | Yes | Yes | - | - | - | - | |||

| Wafer Size (mm) | 300 | 200 | 300 | |||||||

| 2016 Q3 | ||||||||||

| Total DRAM Output Today (300-mm wafer starts per month) | 300K | |||||||||

| Total NAND Ouput Today (300-mm wafer starts per month) | 230K | |||||||||

At present, SK Hynix plans to use the new fab to manufacture only 3D NAND flash memory, but once it is ready, the company will use it according to market demands and will be able to produce both NAND and DRAM at the same production facility. However, the flexibility of semiconductor fabs going forward will be more constrained. Traditionally manufacturers used similar step-and-scan lithography systems from companies like ASML or Nikon to produce both DRAM and 2D NAND. While production of the two types of memory has many differences, it was possible to balance a fab’s output depending on market conditions. Meanwhile, the industry (and SK Hynix) is transiting to 3D NAND and its production relies not only on lithography but also (mostly) on deposition and etching. 3D NAND manufacturing requires chemical vapor deposition (CVD) machines and high aspect ratio etch tools in addition to traditional step-and-scan systems. Once installed, CVD and etching equipment take precious cleanroom space and thus fewer scanners can be installed there. As a result, switching a production line from 3D NAND to DRAM and vice-versa gets more complicated since different equipment has to be installed. On the other hand, the upper floor of SK Hynix’s M14 fab is set to be used for 3D NAND production starting from 2017, which means that it is possible to make DRAM and 3D NAND in the same building.

As NAND flash is moving into three-dimensional space, planar DRAM will keep evolving for a long time (nonetheless, architectures like HBM and other types of 3D DRAM are developing as well) and will require new manufacturing technologies. As fabrication processes get thinner, DRAM makers have to increase the use of multi-patterning techniques, which makes production cycles longer and effectively lowers output of fabs. In a bid to maintain its DRAM production capacities (and ultimately preserve its market share), SK Hynix plans to expand cleanroom space of its C2 fab in Wuxi, China, to install additional step-and-scan systems. The upgrade of the plant will cost SK Hynix approximately $790.68 million (₩950 billion). The company will start the work in July next year and plans to complete them in April 2019. The manufacturer does not disclose output of the production facility officially, but analysts from TrendForce believe that it represents roughly half of SK Hynix’s DRAM output and can process up to 130 thousand wafers (300mm) per month.

In the recent years, SK Hynix announced major plans to expand its existing semiconductor manufacturing capacities and build new ones. In total, the company intends to spend $38.28 billion (₩46 trillion) on fabs in the mid and long-term future, which is a serious commitment to the semiconductor industry in general.

Related Reading:

Source: SK Hynix

16 Comments

View All Comments

BrokenCrayons - Friday, December 23, 2016 - link

This is FAB-ulous news for SK Hynix!Lolimaster - Friday, December 23, 2016 - link

SK Hynix has probably the best logo and the most beautifully designed SSD.iwod - Friday, December 23, 2016 - link

I read a few years ago, the total bits, of NAND, compared to HDD, is still very small. Many Desktop are still selling with HDD ( For some strange reasons ). I am wondering when is the tipping point. Surely Desktop computers aren't sold in much volume in 2017name99 - Saturday, December 24, 2016 - link

240 million "computers" sold in 2015 (which apparently means "desktop PCs, mobile PCs, and servers using the Intel x86 processor architecture" according to the data source)So, for context, that's slightly under the sales of iPhones every year. The iPhones come with, what, let's say about 64GB of flash, the PCs with, what, maybe 500GB of HD. Of course there are other phones, and tablets, and PCs that don't suck, but it seems plausible.

Then of course there's all the HDs that are sold for archive -- either home backup/media center or for data warehouses. Again, sure, some people use flash for these purposes, but most of the people using flash are doing it in an accelerator role (use 500GB of flash to kick up the speed of your 10TB array or whatever).

eldakka - Sunday, January 1, 2017 - link

"Many Desktop are still selling with HDD ( For some strange reasons )."Well, there are actual several 'strange reasons' for this:

1) Cost per gigabyte. A cheap ~500GB SSD is about $0.23/GB, ~$110, for that you can get a 3TB HDD, about $0.037/GB, or even a slower 4TB one for $0.028/GB. So for when price/performance is secondary to price/capacity, say in a cheap office computer or home computer for someone on a tight budget, the a HDD is preferred.

2) Where you want both performance and capacity, then often a desktop will be sold with both a SSD for OS/apps/swap and a HDD for data storage, thus still selling HDDs for these desktops.

3) NAND fab capacity simply cannot physically produce enough NAND to supply all desktops in addition to the demand from phones, laptops, thumbdrives, enterprise and other demands.

We are currently heading into a short-medium term NAND shortage. So expect SSD prices, and any other low-margin NAND incorporating products that can't absord a price rise (e.g. high-margin products like iphones may be able to absorb a NAND price hike) to go up for 12-24 months while companies like SK Hynix expand fab capacity. Thus perhaps making the price/capacity tilt even more towards HDD until the fab issues are sorted.

Bundy - Saturday, April 21, 2018 - link

In Korea, they are rolling out 5G internet, and making these huge investments in technology. Hynix spends $2.6 billion on a new fab, while Samsung's just built two new fabs that cost over $25 billion each. Hynix intends to spend $38.28 billion on fabs in the mid and long-term future.Meanwhile in the USA, Trump wants to bring back the coal industry. SMH