Intel Reports Q4 2020 Earnings: 2020 Delivers A Profitable Pandemic

by Ryan Smith on January 21, 2021 6:15 PM EST- Posted in

- CPUs

- Intel

- Financial Results

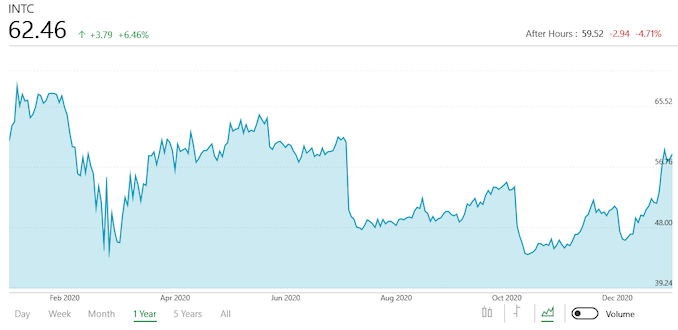

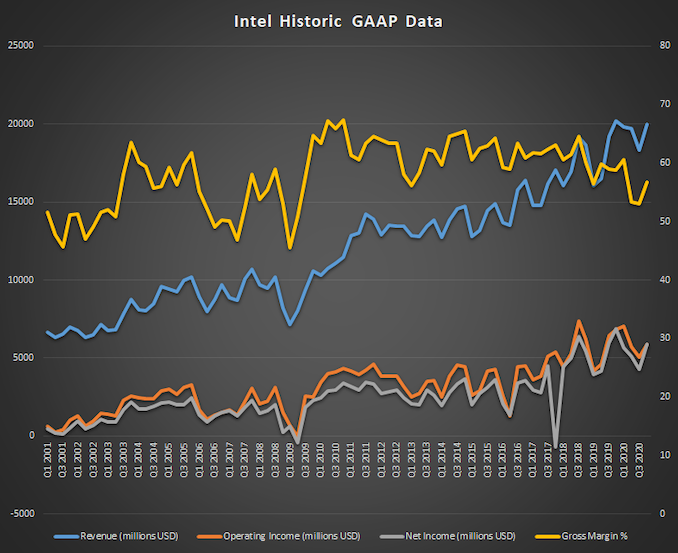

Earnings season is once more upon us, and once again leading the charge is Intel, who this afternoon reported their Q4’2020 and full-year 2020 financial results. The 800lb gorilla of the PC world has seen some unexpectedly strong quarters in 2020 following the coronavirus outbreak, and despite all of the uncertainty that entails, it’s ultimately played out in Intel’s favor. As a result, they’re closing the book on yet another record year, making for their fifth in a row.

Starting with quarterly results, for the fourth quarter of 2020, Intel reported $20.0B in revenue, which is a drop of $0.2B over the year-ago quarter. Intel saw a very good Q4 a year ago, and while Q4’20 is once again their strongest quarter of the year, Intel’s momentum as a whole is starting to back off on a quarterly basis. More significantly, Intel’s net income has dropped 15% YoY, with Intel booking $5.9B there.

Driving this drop – besides the ongoing market distortions caused by the coronavirus pandemic – is a combination of softer gross margins, increased R&D spending, and increased taxes. Intel’s famous gross margin remains below their historical 60% benchmark, coming in at 56.8% for the quarter as Intel continues to ramp up their 10nm capacity. Meanwhile Intel’s tax rate has shifted significantly from 14.4% to 21.8%, eating into the company’s overall net income. Still, at $5.9B for the quarter, Intel is hardly one to complain.

| Intel Q4 2020 Financial Results (GAAP) | |||||||

| Q4'2020 | Q3'2020 | Q4'2019 | Q/Q | Y/Y | |||

| Revenue | $20.0B | $18.3B | $20.2B | +9% | -1% | ||

| Operating Income | $5.9B | $5.1B | $6.8B | +16% | -13% | ||

| Net Income | $5.9B | $4.3B | $6.9B | +37% | -15% | ||

| Gross Margin | 56.8% | 53.1% | 58.8% | +3.7 ppt | -2 ppt | ||

| Client Computing Group | $10.9B | $9.8B | $10.0B | +11% | +9% | ||

| Data Center Group | $6.1B | $5.9B | $7.2B | +3% | -16% | ||

| Internet of Things Group | $777M | $677M | $1.16B | +15% | -16% | ||

| Mobileye | $333M | $234M | $229M | +42% | +39% | ||

| Non-Volatile Memory SG | $1.2B | $1.2B | $1.2B | Flat | -1% | ||

| Programmable Solutions Group | $422M | $411M | $505M | +3% | -16% | ||

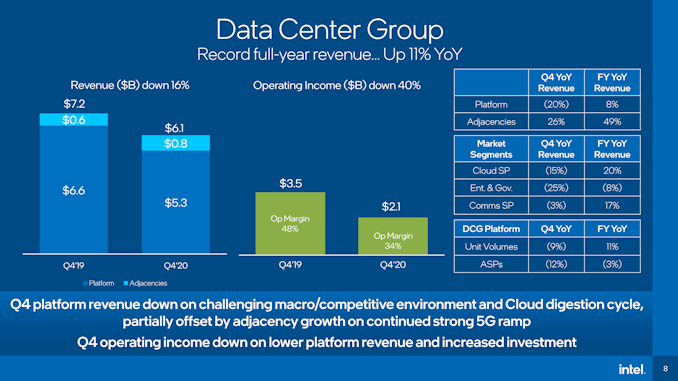

Breaking things down on a group basis, many of Intel’s internal reporting groups have shrunk over the year-ago quarter, buoyed by a handful of other groups. Data center revenue was down 16% to $6.1B, with both platform volumes and ASPs dropping versus the year-ago quarter. Intel cites the competitive marketplace and “cloud digestion cycle” for the difference, though Ice Lake Server only now shipping probably doesn’t help things.

The story is similar for Intel’s IoT, memory, and programmable solutions (FPGA) groups, all of which are down versus Q4’19. Reasons there vary from lower demand for ioT and programmable hardware, to lower ASPs on memory.

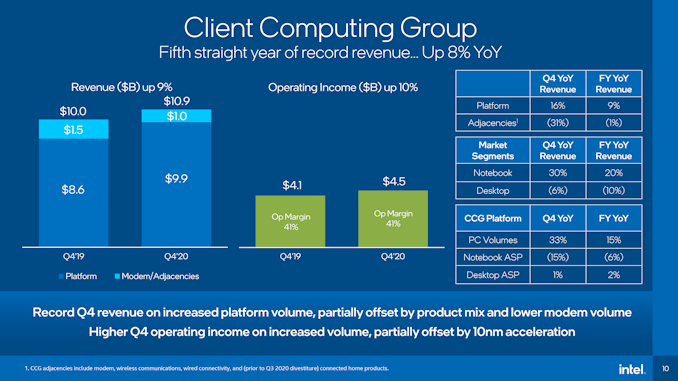

The big winner for the quarter is once again Intel’s client computing group, which was up 9% year-over-year to $10.9B of revenue for the quarter. Despite Intel’s efforts to pivot to being a data-centric company, the manufacturer’s client products remain the single largest piece of the company, so results here can make or break a quarter. In this case sheer demand for PC hardware in the face of the pandemic has driven revenue to new highs, with laptop volumes up 30% over last year. This was more than enough to offset both the drop in desktop sales – down 6% year-over-year – and a drop in laptop ASPs as consumer demand has shifted to Chromebooks and other lower-end hardware.

Full Year 2020

Shifting over to full year results, despite the initial uncertainty that came with the coronavirus outbreak, Intel ended 2020 beating expectations and setting revenue records for the fifth year in a row. Overall the company booked $77.9B in revenue for the year, 8% more than 2019. Intel’s overall net income didn’t get the same kind of kick – dogged by issues similar to their Q4 earnings – but the company is still going out on $20.9B in net income for the year, a 1% drop from 2019.

| Intel FY'2020 Financial Results (GAAP) | ||||||

| FY 2020 | FY 2019 | FY 2018 | Y/Y | |||

| Revenue | $77.9B | $72.0B | $70.8B | +8% | ||

| Operating Income | $23.7B | $22.0B | $23.3B | +8% | ||

| Net Income | $20.9B | $21.0B | $21.1B | -1% | ||

| Gross Margin | 56.0% | 58.6% | 60.2% | -2.5 ppt | ||

| Client Computing Group | $40.1B | $37.1B | $37.0B | +8% | ||

| Data Center Group | $26.1B | $23.5B | $23.0B | +11% | ||

| Internet of Things Group | $3.0B | $3.8B | $3.5B | -21% | ||

| Mobileye | $967M | $879M | $698M | +10% | ||

| Non-Volatile Memory SG | $5.4B | $4.4B | $4.3B | +23% | ||

| Programmable Solutions Group | $1.9B | $2.0B | $2.1B | -7% | ||

Gross margins for the entire year were 56%, reflecting the cost of Intel’s 10nm ramp-up and other fab matters. This was down 2.5 percentage points from 2019.

Looking at Intel’s individual business groups, for the year both the client and data center groups did very well for themselves. Client revenue was up 8% to $40.1B, coming in on the back of higher laptop sales. And that growth really is all from laptops; desktop revenue was down for the year, and even “adjacencies” (Wi-Fi adapters and the like) were down a bit versus 2019.

Meanwhile data center revenue was up 11% to $26.1B, with Intel coincidentally reporting that they shipped 11% more data center chips than in 2019. On the whole, data center growth was driven by cloud and communication service providers, both of whom ramped up their hardware purchases to meet service demands during the pandemic, while enterprise and government sales dipped on the year. Meanwhile it’s interesting to note that on both a quarterly and yearly basis, Intel’s ASPs for the data center group are down; despite the volume, they face an increasing amount of competition.

2020 was also a good year for Intel’s Mobileye and non-volatile storage groups. The automotive segment of the company continues to grow year-over-year (even with the pandemic), adding another 10% to its revenues for 2020. Meanwhile Intel’s storage business set a new record for revenue, growing on the backs of higher bit shipments as well as product launches like Intel’s “Crow Pass” 3rd generation Optane products for enterprise use.

Otherwise the laggards for the year were Intel’s ioT group and programmable solutions group. The IoT group has taken the pandemic on the chin, as IoT device sales have been soft. Meanwhile programmable solutions has been pinched by carriers’ move to 5G and overall declining revenues.

What’s Next?

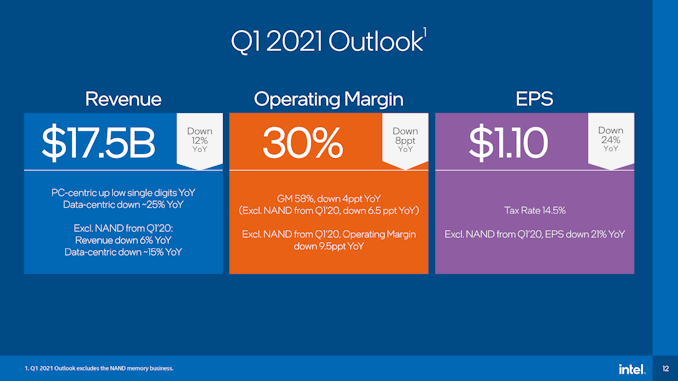

Though we tend not to focus too much on Intel’s future earnings forecasts, their predictions for Q1’2021 warrant a quick look. After 5 years of record revenues, Intel is likely to be facing some tougher years ahead, and their projections reflect this. For Q1 the company expects revenue to drop 12% versus Q1’2020. Even excluding Intel’s NAND memory business, which is being sold off to SK Hynix, and Intel is still looking at a 6% revenue drop on a yearly basis. In particular, the company expects its revenues from its data-centric businesses to drop 15%, leaving client revenue to hold the line.

The good news for Intel is that their next generation of products are close-to or have begun shipping. Rocket Lake, Intel’s upcoming desktop CPU platform, is shipping for revenue this quarter. So are Ice Lake Xeons. And the products to come after those – Alder Lake for clients and Sapphire Rapids for servers – are already both sampling to customers.

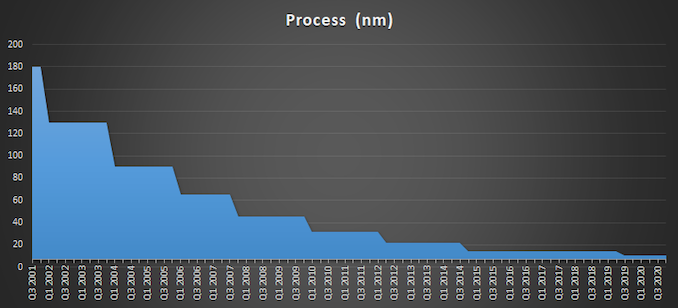

The catch, however, is that Intel is still in the midst of their fab woes. Though the company is making progress on their 7nm process, all guidance from Intel right now suggests that this process won’t be ready at scale until 2023 – two years from now. In the interim Intel will be rolling out more 10nm SuperFin capacity and their Enhanced SuperFin will follow, but Intel won’t be making a big leap forward in fab tech for their products for the next couple of years. At least, not with internally-built chips.

Previously the company had stated that they would discuss outsourcing plans as part of today’s earnings release. But following the surprise hire of Intel veteran Pat Gelsinger to be the company’s new CEO, Intel has put a pause on that announcement. The company is still evaluating the use of external fabs and will have something to announce in the future, but just not today.

In the meantime, it sounds like Gelsinger has hit the ground running. To quote our own Dr. Ian Cutress “[It] sounds like Pat already has his foot in the door. Currently in a state of transition. Feb 15th is more the date of a complete Bob [Swan] exit.” Similarly, in Intel’s earnings call today, Gelsinger commented that he’s been examining Intel’s progress on 7nm manufacturing, and that he’s “pleased” with the progress made thus far. Consequently, with 2023 shaping up to be Intel’s big year for 7nm, Gelsinger also said that he expects the majority of Intel’s 2023 products to be fabbed internally.

Source: Intel

18 Comments

View All Comments

TristanSDX - Thursday, January 21, 2021 - link

"Gelsinger also said that he expects the majority of Intel’s 2023 products to be fabbed internally." - how ? Three 10nm fabs are too low, and their yield is uncertain, may not reach level of 14nm. Maybe they plan to extend 14nm capacity up to 2023 at full volume. Seems that Rocket Lake end up as lower variants in Alder / Meteor Lake lines.Otritus - Thursday, January 21, 2021 - link

Gelsinger also said the majority of products in 2023 will be on 7nm, and that is on track. I expect, that Intel will aggressively retool fabs for 7nm, and take advantage of higher densities to produce more chips per wafer, thereby hitting their targets. Gelsinger is having an aura of confidence reminiscent of old Intel, which makes me optimistic for competition in 2023+.duploxxx - Friday, January 22, 2021 - link

you can redesign 7nm and reduce complexity to a point that density is hardly better than the previous node :) that is what happened with 10nm and that seems to be the case for 7nm.bye bye leap forward.

look at density increase on tsmc 7-5-3nm

azfacea - Friday, January 22, 2021 - link

the only problem with what you are saying is that you are assuming 7nm will work right and be on time and jump over 10nm problems. almost 10nm was an elective class you dropped in college and has no effect on the remaining courses, if anything you can now focus on 7nm.We have never seen a big semi maker fall behind nearly 1.5 generations now and then recover and get back to the leading edge in the next node. maybe intel can do it maybe it cant. time will tell.

azfacea - Friday, January 22, 2021 - link

almost as if*Arsenica - Thursday, January 21, 2021 - link

As 7nm (P1276) is now apparently a 2023 product they should at the very least rebrand it as 5nm or 5N, 5i or something to at least show that it is in the same class as TSMC´s 5N (which by then will likely be shipping 3N).But knowing Intel they are more likely to name it something stupid as 7nm Improved UltraFin++

Deicidium369 - Thursday, January 21, 2021 - link

There was NEVER a point when 7nm WASN'T a 2023 product - other than Xe HPC.Rocket Lake Q1 2021

Alder Lake Q42021 to Q12022 (1 year after Rocket Lake

Meteor Lake Q12023 (1 year after Alder Lake)

Ice Lake SP - Q22021

Sapphire Rapids - Q42021 to Q12022 (3 quarters after Ice Lake SP)

Granite Rapids - Q12023 (1 year after Sapphire Rapids)

Ice Lake SP will be a short term product - but quite a few businesses will snap them up in volume in the uncontested 2 Socket servers - with 128 lanes of PCIe4 (1st mainstream server implementation of PCIe4) and 8 channels of DDR4 3200 ECC... will be a VMWare match made in Silicon Valley

I for one, for my use, do not see a compelling case for Sapphire Rapids over Ice Lake SP - don't need PCIe5 and DDR5 - with 32 lanes of PCIe4 I can attach the 2 dual port 100Gb/s Ethernet NICs I will need... amd on the single CPU Workstations - only need 48 lanes for 2 dual port 100Gb/s Ethernet NICs + the carry over RTX6000.

So Intel 7nm had issues with Xe HPC - since TSMC has not even transitioned from Copper to Cobalt and has not even attempted to fab ALL layers of a piece with EUV - the issue COULD be in the ASML machines themselves - and incompetent Murthy and to a lesser degree Bob Swan.

And so you know, 2H2021 - Intel will be moving some i3 class CPUs to TSMC 5nm and then some to 3nm in 2022... And since it can supply the materials that TSMC can't get in volume - Intel will get full speed production while AMD is trying to supply enough Consoles SOCs so it can actually ship some of it's PC CPUs and GPUs...

You show your ignorance - SuperFin is named as such because of the structure allowed by moving to Cobalt instead of copper - and not just COAG - but the entire M0/M1 layers... TSMC isn't making that small of a feature with copper - which becomes a resistor rather than a conductor at that scale.

TSMC calls it's 10nm class process "7nm" which is far more ridiculous...

Spunjji - Friday, January 22, 2021 - link

"There was NEVER a point when 7nm WASN'T a 2023 product"Then why did they announce delays? Come on, at some point it would have had to have been scheduled for earlier release. 10nm was supposed to be out in 2015, there must have been a time when 7nm was planned a lot sooner than 2023.

"Ice Lake SP ... with 128 lanes of PCIe4 (1st mainstream server implementation of PCIe4)"

Rome has had that since August 2019.

"TSMC calls it's 10nm class process "7nm" which is far more ridiculous..."

It's more dense and power-efficient than both Intel's in-production 10nm (not the fantasy football version they advertised) and their own 10nm. What else should they call it, and why would they do that?

Deicidium369 - Saturday, January 23, 2021 - link

The announced delay was for Xe HPC which was the lead off product for 7nm.Enough of the Supposed to be this and should have been then

EPYC is niche and does not represent mainstream - my statement stands. Ice Lake SP will sell more than the entire history of Epyc combined. So many Intel VM Servers will be replaced by new Intel VM Servers.

TSMC "7nm" and Samsung "8nm" and Intel 10nm are all 10nm class processes - both TSMC and Samsung make every tiny little improvement into a new Product - because they are contract foundries and need to do so.

Not more dense - esp with 10nm SF. more power efficient in the Laptop SOC space than AMD - longer battery life - etc - not that there are very many AMD laptops to actually test...

Must be tough since all your old "go tos" have been OBE (overtaken by events).

5 record years in a row - they must be doing something right.

drothgery - Friday, January 22, 2021 - link

I can't get too worked up about marketing names for processes even as someone who generally likes Intel. The last time process names from anyone had a decent correlation to feature sizes process names were in microns, not nanometers.