AMD Reports Q2 2021 Earnings: Company-wide Growth Drives Doubled Revenue

by Ryan Smith on July 27, 2021 5:25 PM EST- Posted in

- CPUs

- AMD

- GPUs

- Financial Results

- Xilinx

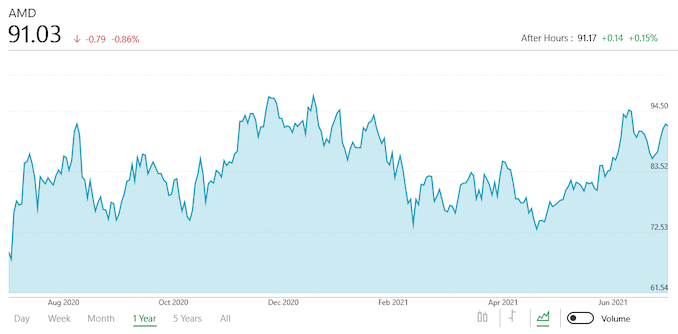

Continuing our Q2 earnings coverage this month, AMD is next out the gate in reporting their earnings. And, has been the story now for most of the last year, AMD is enjoying explosive revenue growth across the company. CPU, GPU, and semi-custom sales are all up, pushing the limits of what AMD can do amidst the current chip crunch, and pushing the company to new levels of profitability in the process.

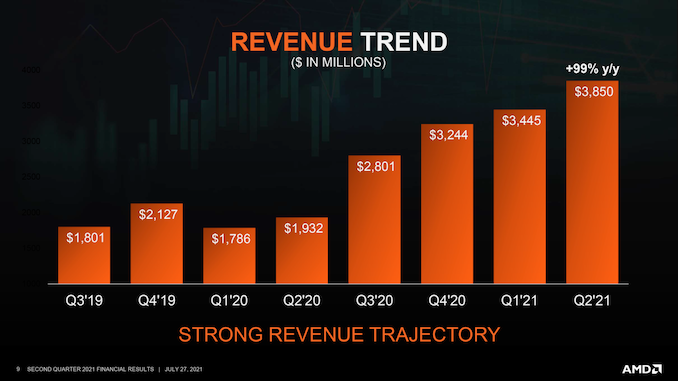

For the second quarter of 2021, AMD reported $3.85B in revenue, making for yet another massive jump over a year-ago quarter for AMD, when the company made just $1.93B in a then-record quarter. Now, half-way through 2021, AMD’s financial trajectory is all about setting (and beating) records for the company, as evidenced by the 99% leap in year-over-year revenue – falling just millions short of outright doubling their revenue.

AMD’s big run-up in revenue is also reflected in the company’s other metrics; along with that revenue AMD’s net income has grown by 352% year-over-year, now reaching $710M. And if not for an unusual, one-off tax benefit for AMD’s Q4’2020, this would have been AMD’s most profitable quarter ever – and indeed is on a non-GAAP basis. Meanwhile, as you might expect from such high net income figures, AMD’s gross margin has risen even further and now sits at 48%, up 4 percentage points from the year-ago quarter and 2 points from last quarter.

| AMD Q2 2021 Financial Results (GAAP) | |||||||

| Q2'2021 | Q2'2020 | Q1'2021 | Y/Y | Q/Q | |||

| Revenue | $3.85B | $1.93B | $3.45B | +99% | +12% | ||

| Gross Margin | 48% | 44% | 46% | +4pp | +2pp | ||

| Operating Income | $831M | $173M | $662M | +380% | +26% | ||

| Net Income | $710M | $157M | $555M | +352% | +28% | ||

| Earnings Per Share | $0.58 | $0.13 | $0.45 | +346% | +29% | ||

Breaking down AMD’s results by segment, we start with Computing and Graphics, which encompasses their desktop and notebook CPU sales, as well as their GPU sales. That division booked $2.25B in revenue for the quarter, $883M (65%) more than Q2 2020. Accordingly, the segment’s operating income is (once more) up significantly as well, going from $200M a year ago to $526M this year.

As always, AMD doesn’t provide a detailed breakout of information from this segment, but they have provided some selective information on revenue and average selling prices (ASPs). Overall, client CPU sales have remained strong; client CPU ASPs are up on both a quarterly and yearly basis, indicating that AMD has been selling a larger share of high-end (high-margin) parts. According to AMD this is the case for both desktop and laptop sales, and making this the fifth straight quarter of revenue share gains.

Meanwhile the company is reporting similarly good news from their GPU business. As with CPUs, ASPs for AMD’s GPU business as up on both a yearly and quarterly basis. According to the company this is being driven by demand for high-end Radeon 6000 video cards, as well as AMD Instinct (data center) sales. AMD began initial shipments of their first CDNA 2 architecture-based Instinct accelerators in Q2, opening the spigot there for data center GPU revenue going into Q3.

| AMD Q2 2021 Reporting Segments | |||||

| Q2'2021 | Q2'2020 | Q1'2021 | |||

|

Computing and Graphics

|

|||||

| Revenue | $2250M | $1367M | $2100M | ||

| Operating Income | $526M | $200M | $485M | ||

|

Enterprise, Embedded and Semi-Custom

|

|||||

| Revenue | $1600M | $565M | $1345M | ||

| Operating Income | $398M | $33M | $277M | ||

Moving on, AMD’s Enterprise, Embedded, and Semi-Custom segment has once again experienced a quarter of rapid growth, thanks to the success of AMD’s EPYC processors and demand for the 9th generation consoles. This segment of the company booked $1.6B in revenue, $1035M (183%) more than what they pulled in for Q2’20, and 19% ahead of an already impressive Q1’21. The big jump in revenue also means that the segment is even further into the black on an operating income basis, continuing to close the gap with the Computing and Graphics segment even with the all-around growth.

Overall, both the enterprise and semi-custom sides of this segment are up on a yearly basis. AMD set another record for server processor revenue this quarter on the strength of EPYC processor sales. Meanwhile semi-custom revenue was up on both a yearly and a quarterly basis, reflecting the continued demand for the latest generation of consoles.

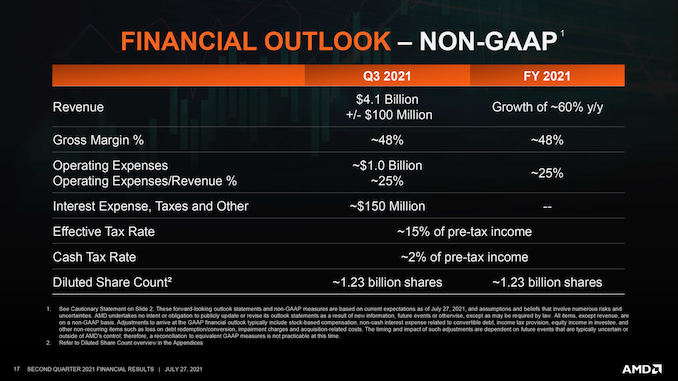

Looking forward, AMD’s expectations for the quarter and for the rest of the year have been bumped up once again. For Q3 the company expects to book $4.1B (+/- $100M) in revenue, which if it comes to pass will be 46% growth over Q3’20. Meanwhile AMD’s full year 2021 projection now stands at a 60% year-over-year increase in revenue versus their $9.8B FY2020, which is 10 percentage points higher than their forecast from the end of Q1.

Finally, while AMD doesn’t have any major updates on the ongoing Xilinx acquisition, the company has reiterated that it remains on-track. Which means that if all goes according to plan, it will close by the end of the year.

Source: AMD

104 Comments

View All Comments

Spunjji - Thursday, July 29, 2021 - link

This comment entails the assumption that designing GPUs to compete with Nvidia at the high-end is relatively trivial and something they just decided not to do.It's not. Just ask Intel, 3DFx, Img tech, Matrox, etc...

Oxford Guy - Thursday, July 29, 2021 - link

Vega, which took a long time to hit the market had identical IPC vis-à-vis Fury X. Identical.Zero improvement.

There are no credible excuses for that and for plenty of other very substantive examples that support my case.

Qasar - Thursday, July 29, 2021 - link

" There are no credible excuses for that and for plenty of other very substantive examples that support my case. "oh ? then post them on here so we can see them too, if not, its STILL just more BS

mode_13h - Sunday, August 1, 2021 - link

> Vega, which took a long time to hit the market had identical IPC vis-à-vis Fury X. Identical.That's not really true. They did make some ISA-level improvements.

http://developer.amd.com/wordpress/media/2017/08/V...

Search for "Differences Between VEGA and Previous Devices", and remember that Polaris came between Fury and Vega. So, for a more complete list of changes, you'd probably also have to consult the Polaris docs.

But that's just the ISA doc. GPU performance is not only about IPC. Vega has other differences, highlighted in the review:

* New memory page management for the high-bandwidth cache controller

* Tiled rasterization (Draw Stream Binning Rasterizer)

* Increased ROP efficiency via L2 cache

* Improved geometry engine

* Primitive shading for even faster triangle culling

* Direct3D feature level 12_1 graphics features

* Improved display controllers

https://www.anandtech.com/show/11717/the-amd-radeo...

I also remember seeing a few benchmarks where Vega 56 had up to a 2x improvement over Fury.

> There are no credible excuses for that

Vega was dual-focused at gaming and machine learning.

Also, by fabbing it on a smaller process node, AMD was able to turn up the clock speed.

With all that said, I don't want to defend Vega as if it was actually good. Clearly, it was lacking in some key respects. I think its origins were from a time when AMD still thought the GPU race was mostly about brute-force. RDNA was obviously an attempt to course-correct.

BTW, I don't really see your point of calling out Vega, specifically. If you go back through the entire GCN range, each was an evolutionary improvement on the previous generation. Vega was entirely consistent with that.

Oxford Guy - Tuesday, August 17, 2021 - link

'That's not really true. They did make some ISA-level improvements.'Just like Parhelia was a great competitor because it had things like glyph smoothing.

A laundry list of mostly superfluous features is irrelevant to the point. Review sites that did clock-to-clock gaming tests found that Vega's IPC is identical — and there is no excuse for that.

What there is is AMD purposefully not being competitive beyond the low midrange so Nvidia could pump prices up and create artificial demand for 'consoles'. It also kept Polaris-forever overpriced and selling.

mode_13h - Thursday, July 29, 2021 - link

> — designing GPUs to sell to mining first and foremostThis just shows the depth of your ignorance on the subject. If AMD cared about miners, they'd actually support GPU compute on those cards!

I know you don't *really* care about facts, if they get in the way of your scapegoating.

That's the biggest problem with your whole conspiracy theory -- it simply doesn't make sense. I get that you're angry and searching for somewhere to target your rage, but you've gotta get past that.

Oxford Guy - Thursday, July 29, 2021 - link

'This just shows the depth of your ignorance on the subject.'Don't expect someone to bother reading your posts when you start them off with empty rhetoric like that. Your flamboyant ad hominem is tiresome.

Qasar - Thursday, July 29, 2021 - link

and your crying and whining about the console scam BS, is tiresome as well, point is ?Oxford Guy - Tuesday, August 17, 2021 - link

'and your crying and whining about the console scam BS'Try posting a rebuttal.

mode_13h - Sunday, August 1, 2021 - link

> Your flamboyant ad hominem is tiresome.Same.

As for empty rhetoric, I've yet to see much else from you. When you do make a case, it's typically weak and not backed by sources or references. The amount of shade you cast, relative to the informational content of your posts is quite high. That's more like a caricature of Oxford than the reality.

On the internet, the only thing that matters is the strength of your argument. I don't care if you're an Oxford prof or a homeless dropout. Since we can't verify your background, it counts for nothing.